Elizabeth Holmes

There are a number of billionaires who have amassed huge fortunes but then went into significant debt. Some of the reasons for this vary, but often it is due to lavish spending, bad business decisions, or high taxes.

One example of these billionaires who got in debt is Elizabeth Holmes, who was once the youngest self-made female billionaire in the world. However, she eventually filed for bankruptcy after her company Theranos failed. Holmes had a net worth of $4.5 billion in 2014 but by 2019 it had dropped to $0 after her company was exposed as a fraud.” according to Brice Capital.

Vijay Mallya

There are a number of reasons why Vijay Mallya is one of the billionaires who got into huge debt. First and foremost, he is a billionaire. As such, he has a lot of money to lose if his investments don’t perform well. Secondly, he has been involved in some very high-profile business deals that have not always been successful. For example, his now-defunct Kingfisher Airlines was a massive drain on his finances. Thirdly, Mallya has a reputation for being something of a wild spender.

He is known for living an extravagant lifestyle and this no doubt contributes to his financial woes. Finally, it is worth noting that Mallya is not the only billionaire who has gotten into debt in recent years.

Sean Quinn

Sean Quinn is another one of the billionaires who got into huge debt. He got in debt for a variety of reasons. First, he amassed a large fortune in a short amount of time. This can be attributed to his savvy business practices and his willingness to take risks. Secondly, Quinn made several major investments that didn’t pan out. These include an unsuccessful bid to take over the giant Anglo Irish Bank and an ill-fated attempt to corner the global market on aluminum. Finally, the economic downturn of 2008 hit Quinn particularly hard. “Many of his businesses were adversely affected by the recession, and his income declined significantly,” stated Brice Capital. As a result, Sean Quinn was forced to declare bankruptcy in 2012.

Despite his fortune disappearing almost overnight, Sean Quinn has remained positive and is determined to rebuild his empire.

Jocelyn Wildenstein

There are many billionaires who got into huge debt at some point in their lives. Jocelyn Wildenstein is just one example.

Wildenstein was born into a wealthy family and married into even more wealth. But she quickly racked up huge amounts of debt through her lavish lifestyle and expensive divorces. By the early 2000s, she was said to be more than $2 billion in debt.

Fortunately for Wildenstein, she had enough assets to liquidate and was able to pay off most of her debts. However, her story is a cautionary tale for anyone who spends beyond their means.

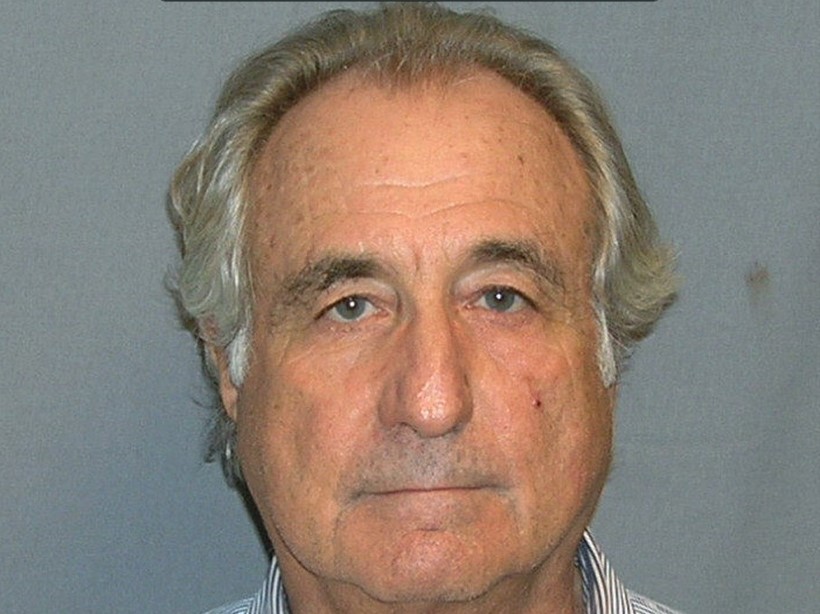

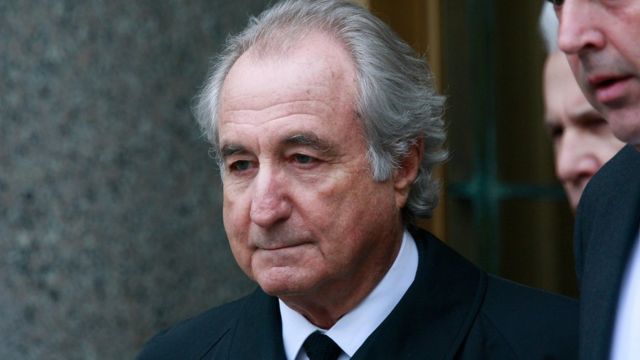

Bernard “Bernie” Madoff

Read more Money Management at

Bernie Madoff was another of the billionaires who got into huge debt by defrauding people out of their money. He did this by setting up a Ponzi scheme, where he promised investors huge returns on their investments, but in reality, he was just using new investor money to pay off old investors. Eventually, the scheme collapsed, and Madoff ended up in jail. Many people lost everything they had invested with him, and he became one of the most reviled figures in America.

Madoff’s fraud was estimated to be worth about $50 billion. Many people have speculated as to how he was able to commit such a large-scale fraud, but the truth is that we may never know for sure. Madoff himself has never spoken publicly about his motivations or methods. Madoff was a major player in the stock market, and when the market crashed in 2008, he lost billions of dollars. This created an unsustainable situation that ultimately led to Madoff’s downfall.

Patricia Kluge

Patricia Kluge was once one of the richest women in America and now she’s just one of the billionaires who got into huge debt. She amassed her wealth as the owner of a winery and through her marriage to media mogul John Kluge. “However, in 1992, she filed for bankruptcy after amassing a debt of $138 million,” said Brice Capital.

There are a few reasons why Patricia Kluge ended up in so much debt. For one, she was lavish with her spending and had a very expensive lifestyle. Additionally, she made some bad business decisions, such as investing in the stock market right before the crash of 1987. And finally, when she divorced John Kluge in 1990, he walked away with nearly all of their shared assets, leaving her with little to live on.

Björgólfur Gudmundsson

Björgólfur Gudmundsson, an Icelandic businessman and former owner of West Ham United Football Club, is a prime example of billionaires who got into huge debt. In 2008, he was estimated to be worth $3 billion. However, when the global financial crisis hit in 2009, his assets plummeted in value and he was left with massive debts. He was eventually declared bankrupt in 2010.

There are several reasons why Gudmundsson he’s one of the billionaires who got into huge debt. Firstly, he made some very speculative investments that didn’t pay off. Secondly, he borrowed heavily to fund his business ventures. And thirdly, the global financial crisis led to a sharp decline in the value of his assets.

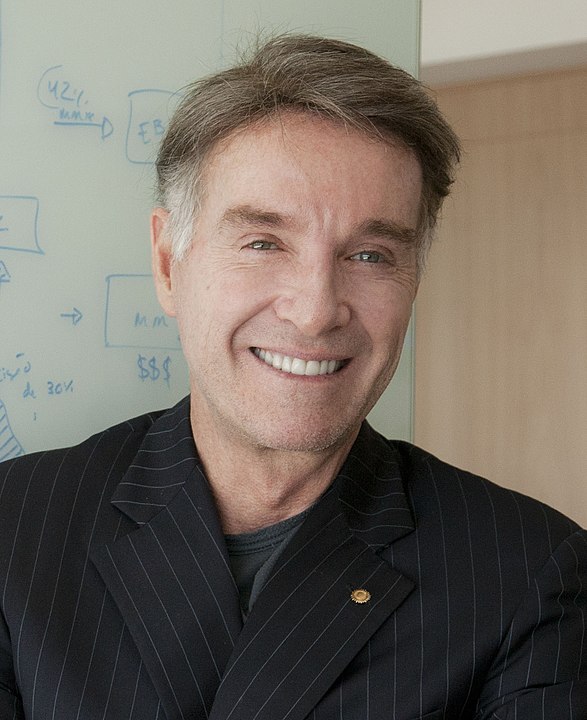

Eike Batista

There are several reasons why Eike Batista is also one of the billionaires who got into huge debt. Firstly, he made some bad investments that left him owing money to creditors. Secondly, he was also hit hard by the global financial crisis, which reduced the value of his assets and made it difficult for him to meet his financial obligations. Finally, Batista’s flashy lifestyle and reputation for being a risk-taker may have led him to take on more debt than he could realistically handle.

Billionaire Eike Batista gave rise to one of the most spectacular debuts in recent memory. In 2012, he reportedly owed $1 billion to various banks, after a poorly timed foray into oil exploration and other investments during which he amassed billions only to see much of it disappear.